UAE Economic Substance Regulations: Amendments – WHAT NEXT!

UAE Economic Substance Regulations: Amendments – WHAT NEXT!

The Dubai government has introduced “Retire in Dubai”, a scheme that gives expats an opportunity to apply for retirement visa. Residents aged 55 and above can make use of this visa to continue their stay in the emirate and the visa can be renewed every 5 years. To be able to apply for retirement visa in the UAE, retirees must fulfill one among the below three financial requirements;

The amended Regulations do not consider natural persons, sole proprietorship concerns, trust and foundations as Licensees. The focus is now only on corporate legal entities (including government entities) and unincorporated partnerships to be considered as Licensees. It has also been clarified that branches shall be considered as extension of legal entity and shall not have separate legal status, subject to few conditions / scenarios.

The amended Regulations exempt the following entities from fulfilling the substance test: Investment Funds Entity which is tax resident outside UAE Local entities (not part of MNE Group) subject to fulfillment of certain conditions Branches of foreign entities subject to tax outside the UAEE

Licensees no longer required to resell goods purchased from foreign connected persons outside UAE to qualify under Distribution Business. Even local sales shall be considered as in-scope activity. Licensees no longer required to provide services to foreign connected persons in connection with business outside UAE. Even services provided in connection with business within UAE shall be considered as inscope activity.

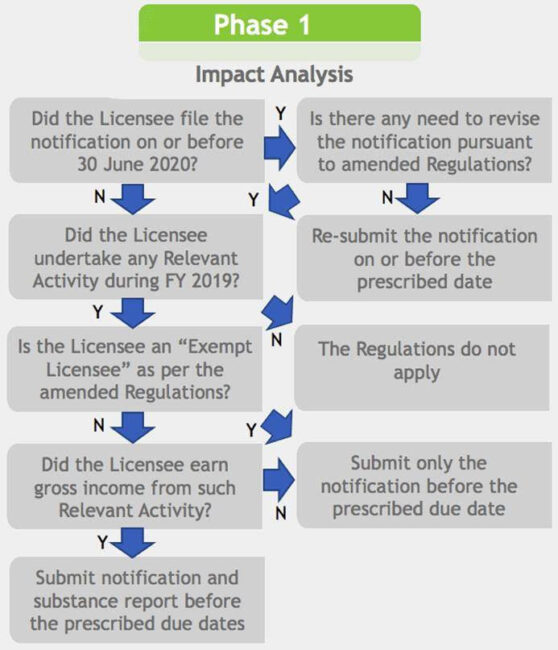

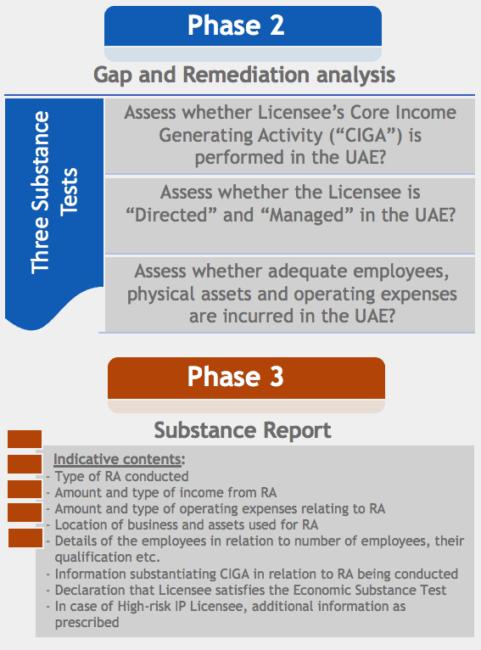

The definition of High Risk IP Licensee and CIGA requirement for IP Business has been rationalized. There would be electronic submission of the notifications and substance report on designated portal provided by Ministry of Finance. Notifications are required to be filed within six months from the end of the Financial Year. ‘Substance Test’ will now be assessed by Federal Tax Authority, being National Assessing Authority. Additional penalties in case of defaults.

Apart from these, a valid UAE health insurance is also a must to avail the scheme. A retired expatriate and their spouse can apply for the visa and they will have to meet the minimum criteria not just the first time, but at the time of renewal as well. Dubai Tourism is collaborating with the General Directorate of Residency and Foreign Affairs to develop the program. According to Helal Saeed Al-Marri, Dubai Tourism’s director general, the initiative has been introduced to “further enhance Dubai’s position as an iconic global city and make it the world’s most preferred lifestyle destination. The retirement programme will contribute towards our tourism economy by facilitating frequent visits from families and friends of the retirees and increasing visitation from markets with a high retiree population,” he said. The initiative is expected to yield positive results for the economy of Dubai. Sectors that include real estate, retail, tourism, healthcare, hospitality, entertainment and finance are likely to benefit from the introduction of retirement visa in Dubai.

“5 year retirement visa is a novel approach initiated by the government of UAE that will permit expats to continue their stay in the emirate. They need not go back to their home country, which will be beneficial not just for the individual, but the economy as well. Many of the expats who work in Dubai, have spent a significant portion of their lives here and has got used to the high quality of life the city provides. Hence, an opportunity to stay back here will be welcomed whole-heartedly” Dubai has been taking numerous steps to improve the lives of expats residing in the emirate. The comfortable & luxurious lifestyle coupled with excellent infrastructure is one among the many factors that attracts residents and expats alike to this ‘safe haven’.